Floify

4.7

102

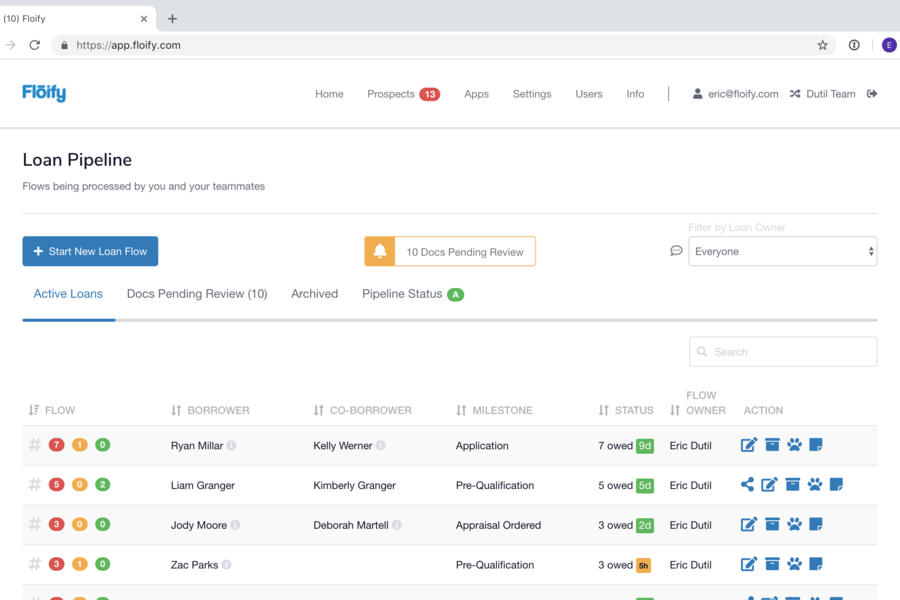

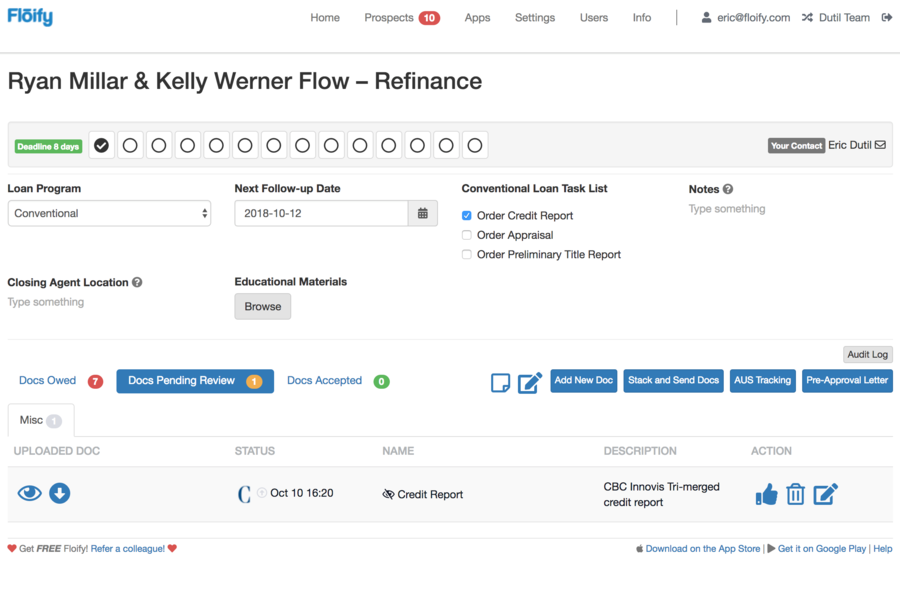

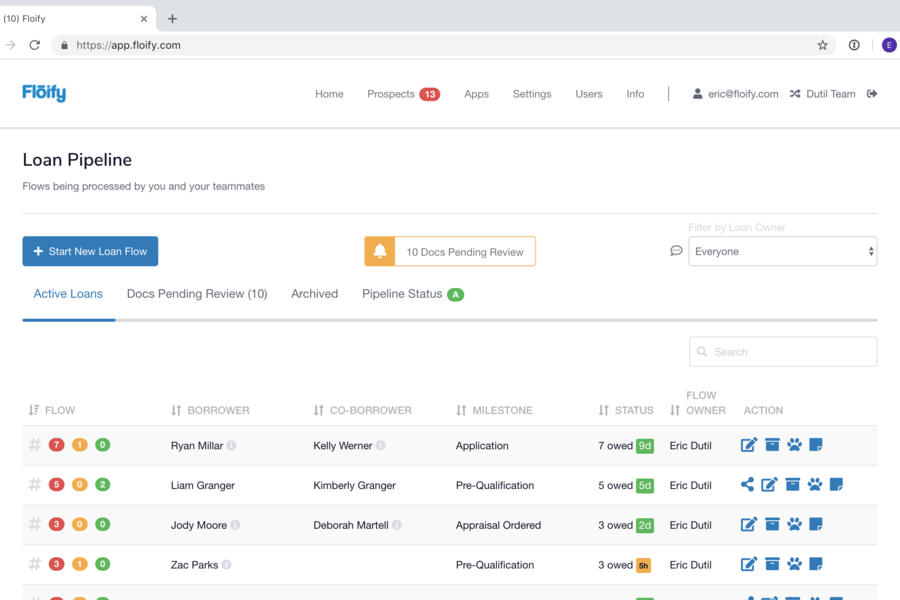

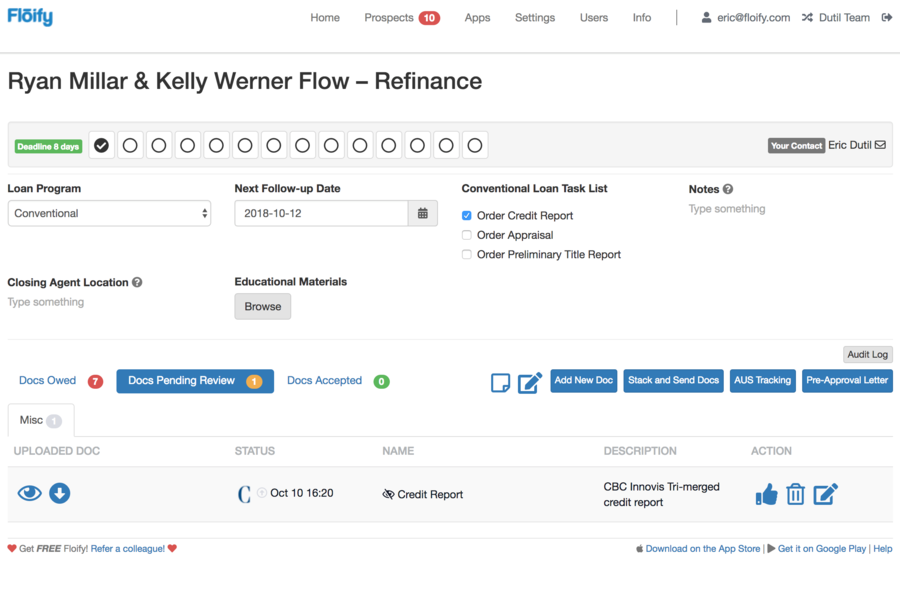

Floify is a SaaS solution for the mortgage industry that streamlines the loan origination process by providing a secure communications and document management portal that is shared between lenders, borrowers, real estate agents, referral partners, and other loan stakeholders. It includes an easy-to-use 1003 mortgage loan application that can be embedded on a lender or originator's website, customized, and seamlessly synced with a respective loan file. Floify keeps borrowers and other stakeholders informed of loan status changes via automated email and text message alerts. It integrates with several dozen product and service providers in the mortgage industry. Floify offers a fixed monthly or annual subscription pricing model with no per-loan fees. Loan originators report being able to save up to 10 days on the origination process.

Strengths

-

Automation

Automates the mortgage process, saving time and reducing errors.

-

Customization

Offers customizable workflows and branding options.

-

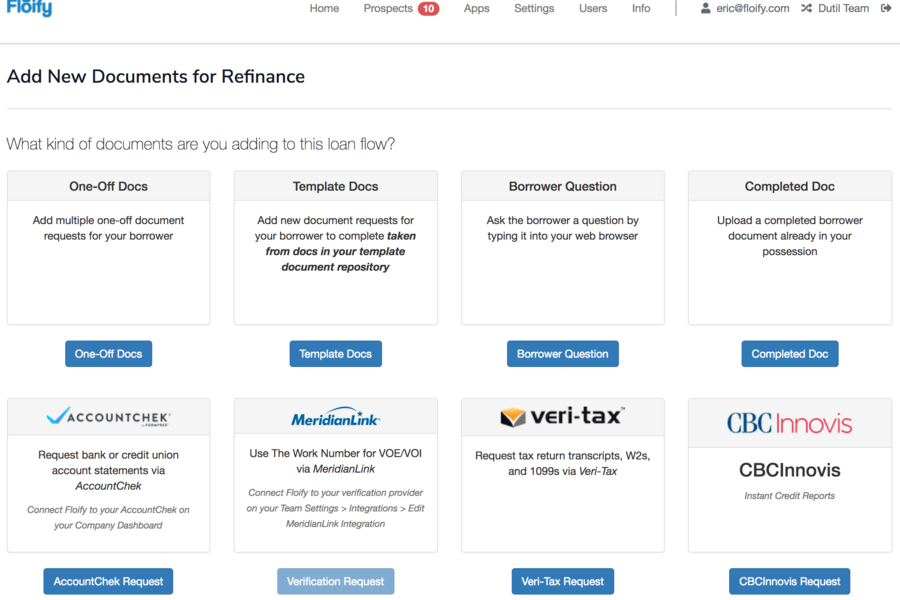

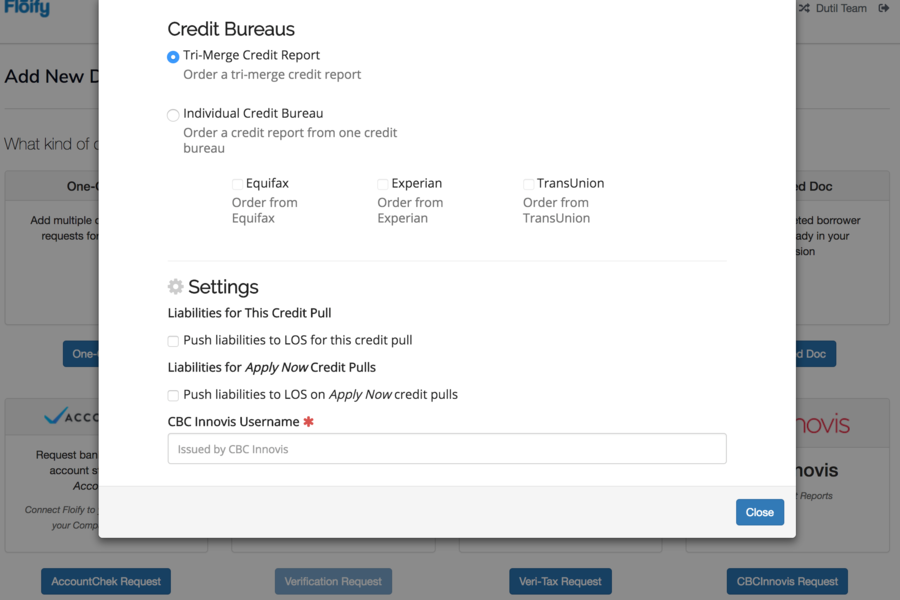

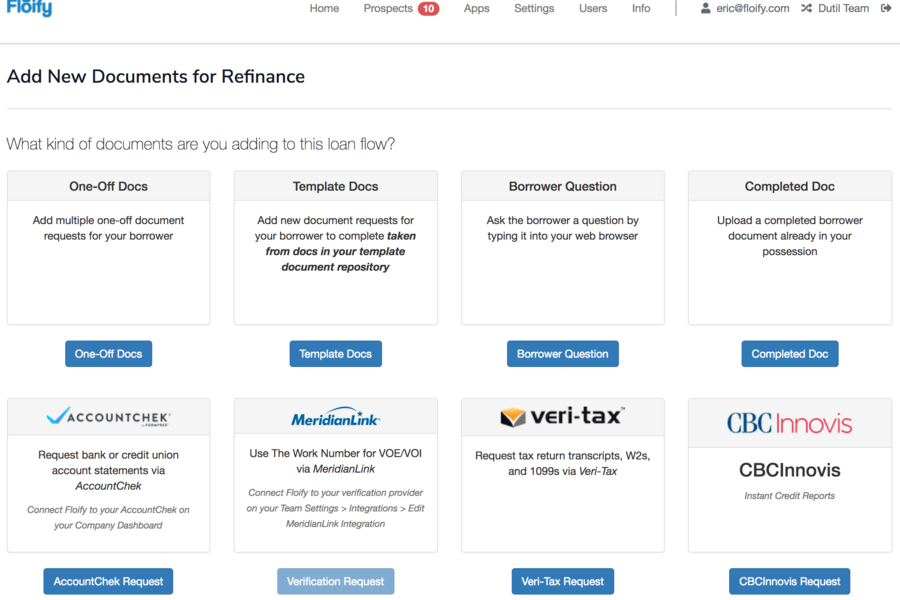

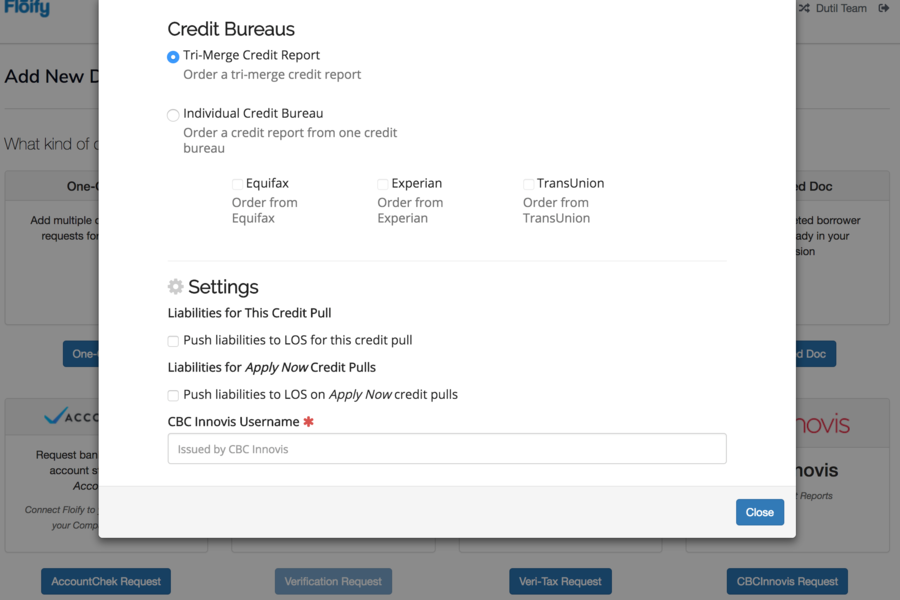

Integrations

Integrates with popular CRMs and loan origination systems.

Weaknesses

-

Pricing

Pricing may be too high for smaller mortgage companies.

-

Learning Curve

May take some time to learn and fully utilize all features.

-

Limited Functionality

May not have all the features needed for larger mortgage companies.

Opportunities

- The mortgage industry is growing, providing opportunities for Floify to expand its customer base.

- Can continue to add new features to stay competitive and meet customer needs.

- Can form partnerships with other companies in the mortgage industry to expand its offerings.

Threats

- There are many other mortgage automation software providers in the market.

- Changes in mortgage regulations could impact the software's functionality and demand.

- A downturn in the economy could impact the mortgage industry and demand for the software.

Ask anything of Floify with Workflos AI Assistant

https://floify.com

Apolo

Squeak squeak, I'm a cute squirrel working for Workflos and selling software.

I have extensive knowledge of our software products and am committed to

providing excellent customer service.

What are the pros and cons of the current application?

How are users evaluating the current application?

How secure is the current application?

Media

Floify Plan

Floify offers three pricing plans starting at $49/month, with additional features and integrations available in higher tiers.

Business

79

Includes access for 1 LO or Support user

Floify's Business plan is the perfect digital point-of-sale solution for single loan originators and small mortgage operations. This plan provides everything lenders need to streamline their loan process from application to clear-to-close – all at a minimal monthly subscription cost.

Secure Borrower Portal

Status and Milestone Updates via Email, Text/SMS, and Smartphone Apps

Progressive Web Apps and Mobile Apps for Android and Apple Devices

Customizable Digital 1003 Application with Spanish Subtitles

Realtor and Referral Partner Portal, including On-demand Pre-Approval Letters

Suite of Productivity Integrations

Automated Asset and Income Verification Integrations

White-Labeled Templates

Unlimited Storage

Mortgage Calculators with Built-in Lead Capture

White-Labeled iOS and Android Mobile Apps

Advanced Compliance Controls

Company Dashboard

Team

250

Includes access for 1 LO + 4 support users working on a single pipeline

Built with growing lending operations in mind, Floify's Team plan offers a comprehensive solution that's engineered to maximize productivity and close loans faster and easier than ever. The Team plan can seamlessly support a single loan originator and up to four support users working on a single pipeline.

Secure Borrower Portal

Status and Milestone Updates via Email, Text/SMS, and Smartphone Apps

Progressive Web Apps and Mobile Apps for Android and Apple Devices

Customizable Digital 1003 Application with Spanish Subtitles

Realtor and Referral Partner Portal, including On-demand Pre-Approval Letters

Suite of Productivity Integrations

Automated Asset and Income Verification Integrations

White-Labeled Templates

Unlimited Storage

Mortgage Calculators with Built-in Lead Capture

White-Labeled iOS and Android Mobile Apps

Advanced Compliance Controls

Company Dashboard