Nomics API

0

0

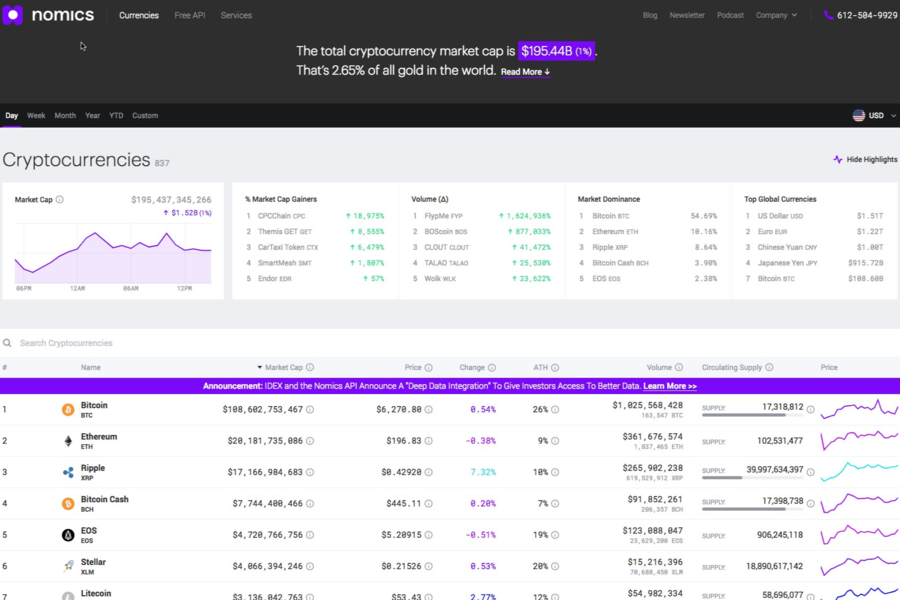

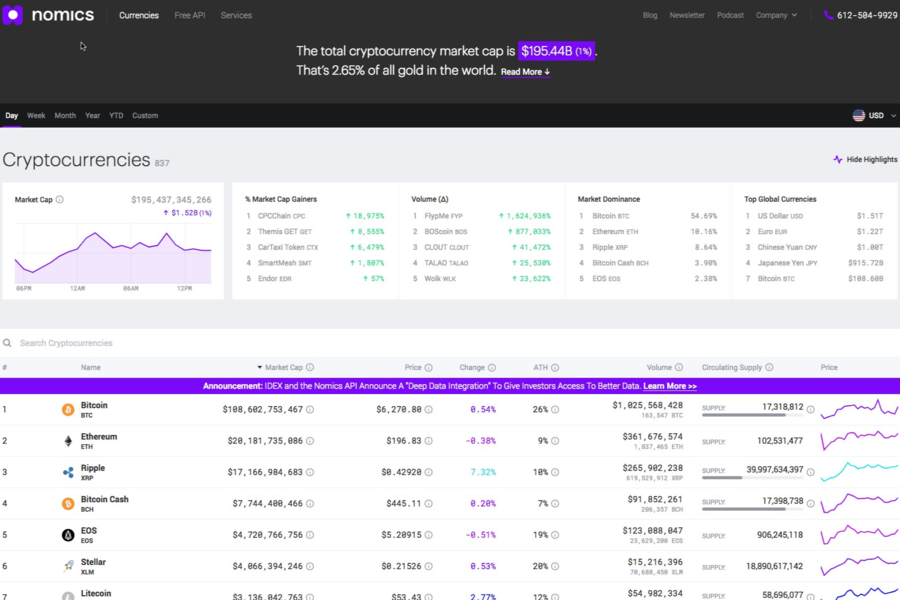

The best free cryptocurrency and bitcoin API. Programmatically access current and historical prices, markets and exchange rate data from exchanges like Binance, Gemini, GDAX, etc.

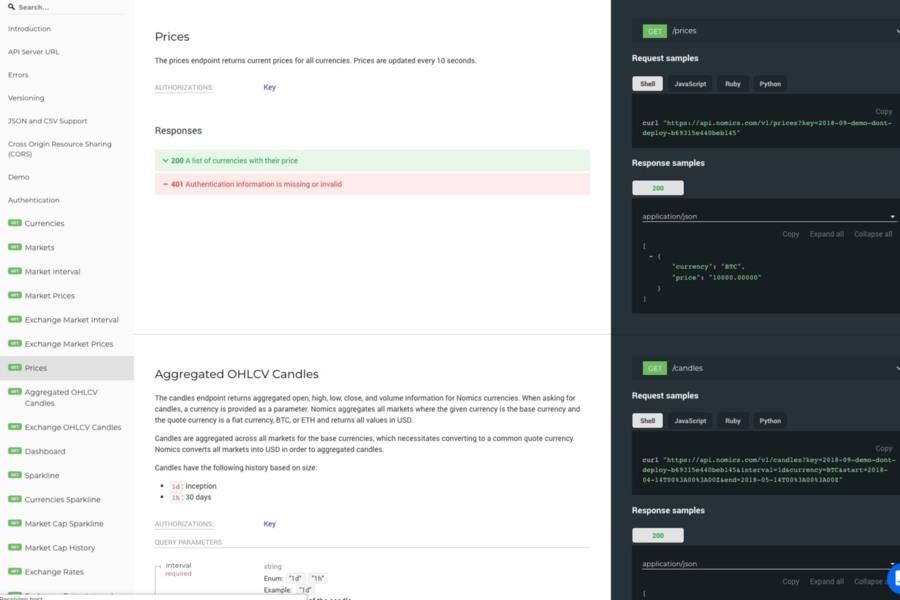

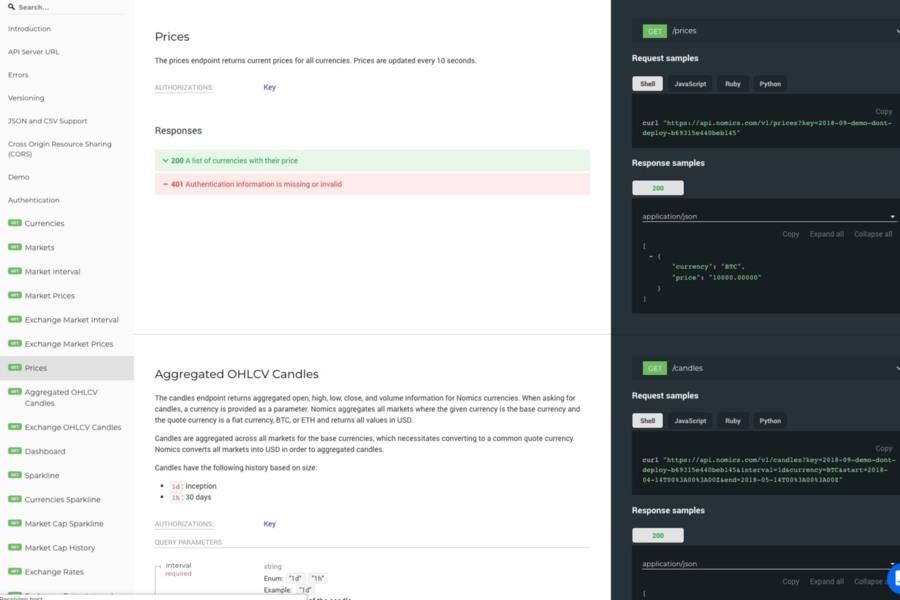

Nomics' free (and paid) crypto exchange data API comes with dozens of endpoints, including endpoints that return sparkline, exchange rate, all-time high (ATH), and supply data. Also included are historic candle/OHLC data for cryptoasset trading pairs on exchanges like Bithumb, Binance, Bittrex, Bitfinex, Bitflyer, Gate.io, Coinbase Pro/GDAX, Gemini, HitBTC, Kraken, and Poloniex. Finally, the API’s free tier also allows fintech developers to programmatically retrieve current and historical prices of cryptoasset tokens like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC).

One notable difference between Nomics’ API and competition is that the Nomics product has no rate limits. For example, CryptoCompare and CoinMarketCap’s APIs all limit the number of application programming interface calls that can be made per minute, whereas Nomics does not currently impose such limits. “Right now, as far as I know, we’re the only cryptocurrency and bitcoin price API that has normalized historical raw trade data,” said CEO Clay Collins.

Collins is fond of noting that Nomics is an “API-first company.” “We actually created our crypto market data API prior to creating the front-end website for Nomics,” says Collins, “and Nomics uses the exact same free API that our customers use.” In other words, the developers of the Nomics website don’t have special access to Nomics’ market database but instead uses the API to build their crypto price aggregation website. The company insists that because they make money from their API—rather than their website—that users are not officially competing with Nomics if using their API. “Use our API to compete with CoinMarketCap, CryptoCompare, OnChainFX, Nomics or anyone else... you’re only really competing with us if you’re competing with our API” claims Collins.

In addition to their free plan, which is great for pricing websites and apps (and high-latency tooling for portfolio or price management) Nomics also offers paid API access for enterprises and funds who need high-fidelity, normalized, primary-source and gapless raw trade/tick data and order book data. According to the company’s website, the paid plan is great for funds, family offices, and professional traders who are: (1) doing deep analysis that requires as many data points as possible (i.e. tick data vs. candlestick/OHLC data), (2) creating new aggregate pricing methodology, (3) creating custom OHLC candles, (4) need low-granularity data for training machine learning models, or (5) need to backtest trading algorithms. The paid plan is also a fit if service level agreement (SLAs), uptime guarantees, and contracts are needed.

Ask anything of Nomics API with Workflos AI Assistant

Apolo

Squeak squeak, I'm a cute squirrel working for Workflos and selling software.

I have extensive knowledge of our software products and am committed to

providing excellent customer service.

What are the pros and cons of the current application?

How are users evaluating the current application?

How secure is the current application?

Media