Sumsub

4.3

40

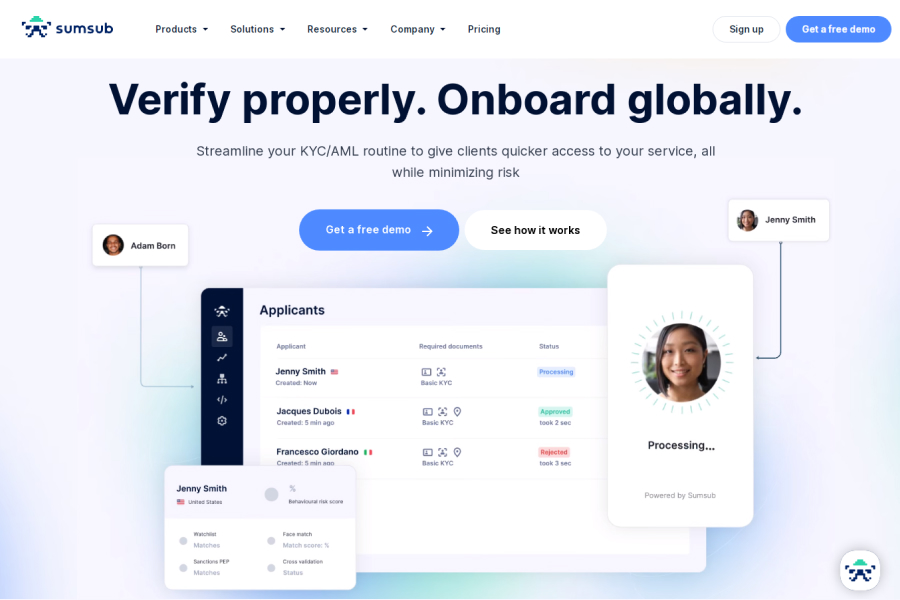

Sumsub is a verification platform that offers customizable solutions for KYC/AML, KYB, Transaction Monitoring, and Fraud Prevention. It has over 2,000 clients across various industries.

Strengths

-

Efficient KYC process

Automated verification process saves time and resources

-

Flexible integration options

Can be integrated with various platforms and APIs

-

Compliance with regulations

Meets regulatory requirements for KYC and AML

Weaknesses

-

Limited customization options

May not be suitable for businesses with unique verification requirements

-

Relatively high pricing

May not be affordable for small businesses

-

Limited language support

Currently supports only a few languages

Opportunities

- Increasing need for secure and efficient verification processes

- Can target businesses in new regions and industries

- Can expand integration options to reach more customers

Threats

- May face competition from larger and more established KYC providers

- Regulatory changes may require significant changes to the product

- Data breaches or other security incidents could damage the product's reputation

Ask anything of Sumsub with Workflos AI Assistant

https://sumsub.com/

Apolo

Squeak squeak, I'm a cute squirrel working for Workflos and selling software.

I have extensive knowledge of our software products and am committed to

providing excellent customer service.

What are the pros and cons of the current application?

How are users evaluating the current application?

How secure is the current application?

Media

Sumsub Plan

Sumsub offers a flexible pricing model with three versions, starting at $99/month, each with varying features and customization options.

Enterprise - Custom

Free Trial

Take advantage of everything Sumsub’s all-in-one verification platform can offer. Verify documents, business entities, and transactions; review corner cases quickly; and customize verification flows for maximum pass rates worldwide.

Custom integration with the help of our solution architect

Your personal customer success manager

Single sign-on (SSO)

Priority support via chat

White labeling

Reusable KYC

API integration

Basic

1

1 Verification

For smaller businesses who want to strengthen fraud defenses.

$149 min. monthly commitment

ID Verification

Liveness & Face Match

Questionnaire

Compliance

1

1 Verification

For businesses committed to regulatory compliance.

$299 min. monthly commitment

Everything in Basic

AML Screening

Ongoing AML Monitoring

Address Verification

Flex

1

1 Verification

For businesses who handle risky transactions.

Pre-payment starting from $5000

Everything in Compliance

Flexible verification options